Transforming development expertise into aligned, risk-adjusted returns for sophisticated investors

4K Asset Management was founded with a clear mission: to deliver institutional-quality real estate opportunities to accredited investors seeking transparency, alignment, and disciplined execution.

Built on the foundation of Jerad Graham’s experience as a developer with Kastelo Development and as the leader of J3 at eXp Commercial, 4K combines on-the-ground operating expertise with a rigorous investment platform. This dual perspective allows us to source, underwrite, and execute boutique multifamily development projects with the type of standards demanded by institutional capital, at a scale accessible to private investors and smaller family offices.

What makes us different?

Most private real estate funds were designed for either institutions with billion-dollar budgets or individual investors who don’t ask many questions. 4K Asset Management was built for a different audience: sophisticated investors and family offices who want access to institutional-quality opportunities without sacrificing clarity and alignment.

Our edge comes from experience earned across the full real estate cycle in over $600M of development and tens of millions worth of brokerage transactions. Our managing partner, Jerad Graham, was elected as Chairman of the National Agent Advisory Committee at eXp Commercial and named Mentor of the Year for contributing to the success of other agents. He also leads our affiliate, Kastelo Development, building ground-up housing projects. That is a unique combination of experience operating, building, and advising for an asset manager.

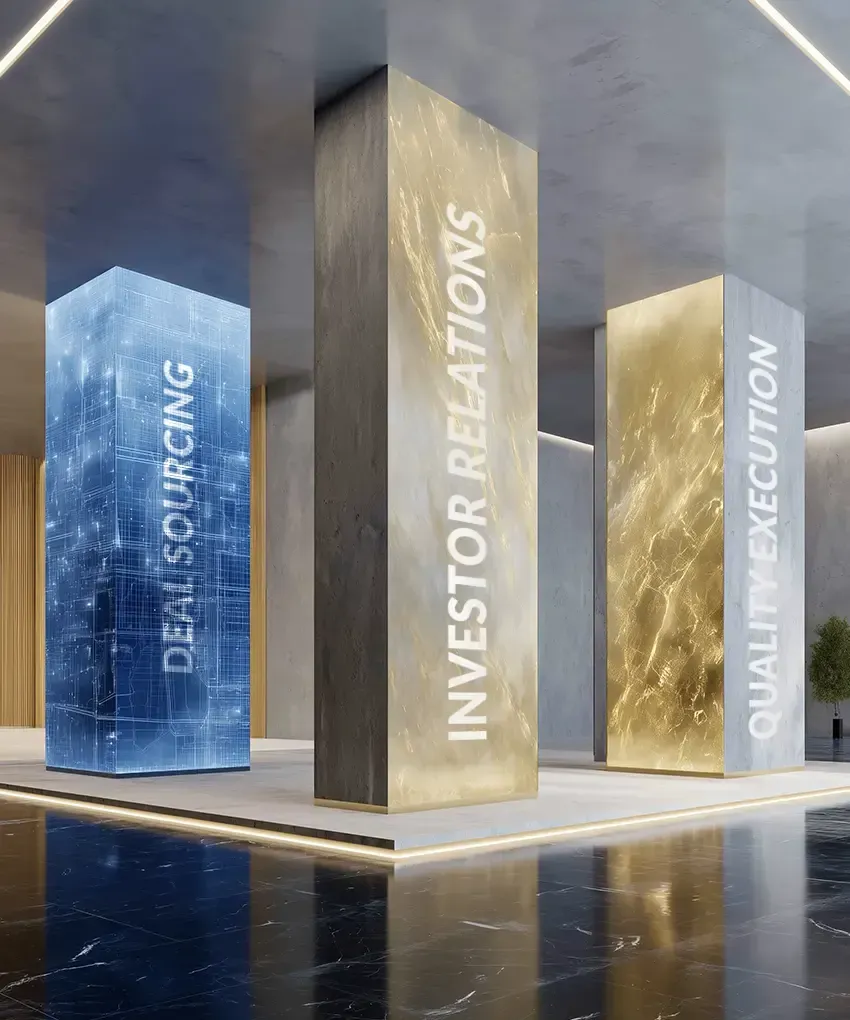

At 4K, we’ve distilled those lessons into three commitments: selective deal sourcing, disciplined quality execution, and transparent investor relations. These pillars guide how we find opportunities, deliver results, and earn the trust of the investors we serve.

Deal Sourcing

Our established network, including J3 brokered by eXp Commercial, provides unique access to high quality deal flow before it hits the market.

Quality Execution

Our full cycle development experience and relationship with Kastelo Development allows us to recognize and mitigate risks for improved execution.

Investor Relations

Our promise is to remain systematically engaged with our investors from the first conversation through to the end of any investment period.

Here's how we do it.

Deal Sourcing

At 4K Asset Management, we only pursue opportunities in neighborhoods with high demand and constrained supply. This creates built-in support for both value and income, even in shifting markets.

With more than a decade in the South Florida market, we have established relationships and direct access to owners, operators, and off-market opportunities. Our affiliated brokerage team, J3 brokered by eXp Commercial, gives us even more exclusive access.

We are extremely selective. Projects start with strong fundamentals, and we don't chase deals that don’t meet our standards.

Quality Execution

Real returns are built by mitigating risk. It's easy to make an investment look good in a spreadsheet or on a webinar, but success depends on disciplined execution by experienced operators. Our team has delivered over $600,000,000 of complex mixed-use projects from concept to completion. That hands-on experience with underwriting, scheduling, and risk management is rare with asset managers.

We build predictability into the process by using conservative assumptions, holding a margin for error, and aligning with contractors through clear contracts and accountability. The goal with our affiliated development company, Kastelo Development, is straightforward: protect downside risk while creating consistent, risk-adjusted returns.

Investor Relations

Investors deserve clarity, not complexity. At 4K, we keep communication honest and straightforward—no hidden terms, no confusing structures. You’ll always know where your capital is, how a project is progressing, and what decisions are being made.

We treat investors as true partners. Reporting is clear, updates are frequent, and we share both wins and challenges openly. Our priority is building trust by making complex projects simple to follow and aligned to your interests.

Our approach is modeled on the standards set by the Institutional Limited Partners Association (ILPA), but right-sized for individual investors and family offices. That means giving you transparency, reporting discipline, and alignment of interests that institutions demand, without the bureaucracy or barriers to entry. You get the benefit of institutional-quality communication, scaled to fit your needs.